Non-China Global[1] Electric Vehicle Deliveries[2]

Recorded 4.273 Mil Units in 2022, a 26.2% YoY Growth

- Tesla ranked top / Hyundai-KIA ranked 3rd

in terms of EV deliveries to non-China market

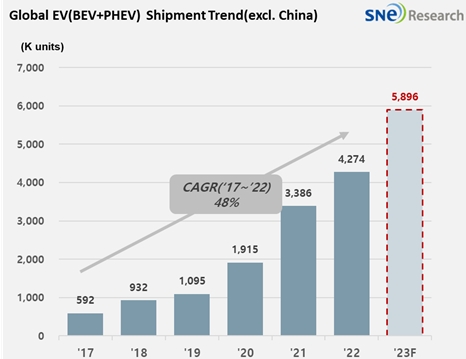

The

total number of electric vehicles registered in countries around the world except

China from January to December 2022 was 4.273 million units, a 26.2% growth

from the previous year. According to the Global Monthly EV & Battery Shipment

Forecast based on the Tracker data provided by SNE Research, the global EV

deliveries in 2023[3] are expected to be

around 5.896 million units.

(Source: Global Monthly EV

& Battery Shipment Forecast – January 2023, SNE Research)

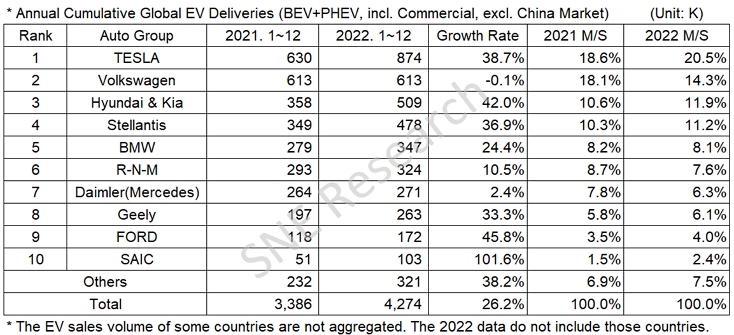

Following 2021, Tesla remained top on the list with its main models, Model 3 and Y, leading the expansion of Tesla in the non-China market and recorded 38.7% of growth in 2022. Next on the list, Volkswagen group posted degrowth in 2022 but still sold more than 600,000 units from its EV line-up including E-Tron series, Porsche Taycan, and Volkswagen ID series. The 3rd place on the list was taken by Hyundai-KIA which sold approximately 509,000 units in 2022 and recorded 42.0% YoY growth. Offering a variety of options to customers in each segment such as IONIQ 5 / EV 6 and Kona / Niro seemed to help the Korean auto group keep the growth momentum in 2022.

(Source: Global EV and Battery

Monthly Tracker – January 2023, SNE Research)

Among the top 10 companies, SAIC Motor achieved a trip-digit growth in 2022 which was driven by the export of Air EV to the Asian region. Air EV is an electric city car in the same segment as Hongguang Mini, the main model for the Chinese domestic market.

(Source: Global EV and Battery Monthly

Tracker – January 2023, SNE Research)

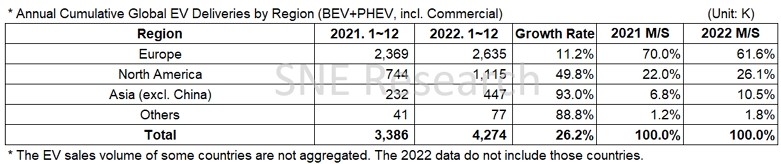

By region, all of them maintained their growth momentum based on increasing deliveries of electric vehicles. Since the implementation of Inflation Reduction Act by the US government to lower its dependence of mineral resource in China, Europe has been also preparing for the Raw Materials Act (RMA) to reduce its dependence on the Chinese supply chain for raw materials, establish Euro-centric supply chain and minimize any disadvantages that may be incurred from the IRA implementation. In 2023, attentions should be drawn to impacts from invisible warfare waged by the two economic powers, Europe and the US, after reshuffling their supply chains where China will be ruled out.

[1] The xEV sales of 80 countries are aggregated (excl. China).

[2] Based on electric vehicles (BEV+PHEV) delivered to

customers or registered during the relevant period.